กลยุทธ์ด้านภาษี

“IRPC Group strictly adheres to the principles of sustainable transparency and fairness. When engaging with tax-related matters, these principles are embedded at all levels of our organization to ensure alignment in tax approaches among all IRPC Group companies and to promote good governance and accountability at all times. We are committed to conducting our business in full compliance with relevant rules, laws and regulations, aiming to build sustainable trust with stakeholders and societies where we operate.”

In that spirit, our tax policies consist of 4 pillars:

Tax Code of Conduct: We strive to achieve sustainable and competitive company taxation and sustainable value and growth including good corporate tax citizenship with added value for society.

- Manage the taxation for stakeholders’ benefits by paying tax properly as required by law.

- Taxed where the economic activities generating the profits are performed.

- Aware of direct and indirect risks from aggressive tax planning and do not use contrived or abnormal tax structures that are intended for tax avoidance and have no commercial substance.

- Transactions between related parties are based on arm’s length principle to ensure that the fair share of taxes is paid with respect to our function performed and our business strategies.

Tax Alignment with Corporate Strategy and Business Goal: IRPC pursues a tax strategy that is principled, transparent and sustainable in the long term as well as considers tax impact for investments and new transactions. For the benefit of stakeholders, IRPC Group will consider tax incentives/exemption available for our commercial activities.

Tax Risk Management: IRPC considers tax risks to ensure that tax risks are identified, managed, and reported to the management and our tax positions are supported by relevant laws. We will regularly review relevant laws to ensure that emerging risks are addressed.

Tax Transparency: All relevant tax information will be timely submitted to governing authorities and enhancing transparency of our tax affair, fulfilling all statutory disclosure requirements on taxation.

IRPC Group Tax Strategy and Tax Policy have been approved and endorsed by the Board of Directors and has appointed Accounting Department to be responsible for the development and implementation of tax matters and providing assurance based on our tax compliance and management. For more information on IRPC Group Tax Policy.

Tax Reporting

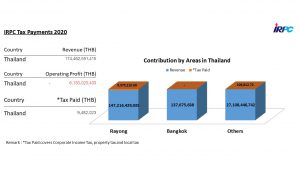

In order to emphasize our transparency and corporate governance, taxes paid to Thailand, which only one country where IRPC has operated business, are disclosed. Revenue, operating profit, and tax paid for the Year 2020 as shown below.

Reported tax rate and cash tax rate for the year 2020

Financial Reporting |

FY 2019 |

FY 2020* |

Calculated Average Rate |

Earnings before Tax |

-1,924,237,810 |

-7,683,762,822 |

|

Reported Taxes |

-778,672,577 |

-1,553,742,419 |

|

Cumulative acceptable adjustments* |

0 |

0 |

|

Effective Tax Rate (%) |

40.46655 |

20.22111 |

24.27576 |

Cash Taxes Paid |

95,597,066 |

54,957,259 |

|

Cash Tax Rate (%) |

-4.96805 |

-0.71524 |

-1.56697* |

Remark: *‘Cumulative acceptable adjustments’ will be calculated based on amounts in two of the ‘reasons’; 1. Group-wide net operating losses (in FY2020); 2. Single jurisdiction tax code

IRPC operates business with transparency which complies with applicable laws as good corporate tax citizenship with our aim to add value for all stakeholders. Those two reasons for the lower ‘reported tax’ rate is explained below:

One reason for the lower ‘reported tax’ rate is single jurisdiction tax code, with lower rates for Thailand compared with industry average: Revenue Code Amendment Act No. 42 B.E. 2559 dated 3 March 2016 grants a reduction of the corporate income tax rate to 20% of net taxable profit for accounting periods which begin on or after 1 January 2016.

According to 2020 IRPC’s 2020 Financial Statements, Note 17, 43, Income not subject to tax in 2019 is 109 million THB, and in 2020 is 65 million THB. For IRPC, this amount is made up of:

- Recoverable tax assets is done in accordance with Thai Financial Reporting Standards 36 (Impairment of Assets)

- According to Code of Revenue Section.65 Bis (10), dividends from the Stock Exchange and subsidiaries which is recognized as income but is not subject to tax.

Under the Investment Promotion Act B.E. 2520 (1977) a board of investment (“BOI”) was established to promote both foreign and Thai investment by providing tax and non-tax incentives. The Investment Promotion Act has been amended from time to time since its enactment to make it appropriate to changing global and domestic economic situations. The Investment Promotion Act (No. 4) B.E. 2560 (2017) became effective on 25 January 2017.

The legislation allows the BOI to grant a “promoted company” corporate income tax exemptions of up to 13 years for businesses that use high technology and innovation and for businesses in research and development (R&D). It also allows for an exemption from import duty on goods imported to be used in R&D activities. Furthermore, tax losses incurred during the tax-exemption period could be carried forward and used within five years after the tax-exemption period expires.

IRPC has been granted privileges by the Board of Investment. Full details are included in IRPC’s 2020 Financial Statements, Note 36, P.56 , including the duration of the privileges and affected revenues. The tax burden reduction is 299 million THB in 2019 and 0 million THB in 2020 (IRPC’s 2020 Financial Statements, Note 17, P.43)

All the information towards Effective Tax Rate is publicly available in the corporate financial statement. [Link]

Live Stream

Live Stream