2568-05-9

IRPC Forms Crisis Unit, Eyes ASEAN Growth

IRPC establishes a Crisis War Room to tackle global volatility while advancing its core business and megatrend-driven investments in high-value petrochemicals across ASEAN.

To navigate mounting global economic and trade uncertainties, IRPC Public Company Limited has launched a dedicated Crisis War Room aimed at enabling swift, real-time responses to market volatility. The initiative, announced on 9 May 2025 by President and CEO Mr Terdkiat Prommool, is part of a broader strategy to strengthen the company’s long-term investment position. At the same time, IRPC is reinforcing its core operations through improved production efficiency, cost reduction, and sound financial risk management. These efforts are anchored in two strategic pillars: 1. Core Up Lift and 2. Step Up & Beyond.

Core Up Lift Strategy

This strategy aims to optimize and future-proof IRPC’s petroleum and petrochemical operations. Key components include:

- Commercial Excellence: Increasing domestic diesel sales and expanding into high-demand markets for premium fuels like Low Sulphur Diesel and Jet A-1.

- Specialty Portfolio Expansion: Prioritising high-value petrochemical products such as phthalate-free polypropylene (PP) for medical and food packaging, and ultra-high molecular weight polyethylene (UHMWPE) used in engineering applications. These are being positioned for growth in ASEAN markets including Vietnam, Malaysia, and Indonesia.

- Optimisation & Competitiveness: Controlling petrochemical costs while co-developing innovative specialty resins with strategic partners.

- Asset Management: Unlocking value from land within the IRPC Industrial Estate and Port in Rayong Province for logistics and investment expansion.

- Subsidiary Governance: Strengthening oversight of group companies and exploring joint ventures to create new revenue streams.

2.Step Up & Beyond Strategy

Looking beyond its core business, IRPC is exploring new growth avenues by leveraging industrial expertise to tap into five global megatrends, including surface coatings, healthcare (especially hospitals), and recycling. Strategic partnerships are being pursued both domestically and internationally.

Q1 2025 Financial Results

IRPC reported Q1 2025 net sales of THB 62.224 billion, down 1% from Q4 2024, largely due to a 4% decline in sales volume, despite a 3% rise in average selling prices in line with crude oil trends.

- Petroleum operations were affected by a reduced Market Gross Refining Margin (GRM), due to weakened product-to-crude spreads.

- Petrochemical operations saw lower Market Product to Feed (PTF), particularly in the olefins segment, amid a slow recovery in demand.

- Utilities maintained stable gross margins.

The Market Gross Integrated Margin (GIM) stood at THB 3.886 billion (USD 6.34/barrel), down 31% from Q4. Despite global oil price volatility, inventory gains amounted to THB 632 million (USD 1.03/barrel), contributing to an Accounting GIM of THB 4.518 billion (USD 7.37/barrel), down 28% quarter-on-quarter.

EBITDA fell to THB 1.596 billion, a 50% decline, with depreciation at THB 2.328 billion (down 4%) and net financial costs at THB 591 million (down 6%) following loan repayments. However, a THB 657 million investment loss was recorded, compared to a THB 223 million profit in Q4 2024. IRPC ultimately posted a net loss of THB 1.206 billion, up 7% from the previous quarter.

Market Outlook

Crude oil and petrochemical markets remain subdued amid continued macroeconomic headwinds and U.S. tariff measures. While Q2 seasonal refinery maintenance is expected to suppress crude demand, rising output from OPEC+ could offset tightening supply—though Middle East tensions may moderate the effect.

Petrochemical demand is forecast to stay flat or subdued. However, HDPE pipe demand is projected to rebound with Asia’s construction season. The sector remains vulnerable to factors such as China’s real estate market and domestic production expansions.

Corporate Social Responsibility

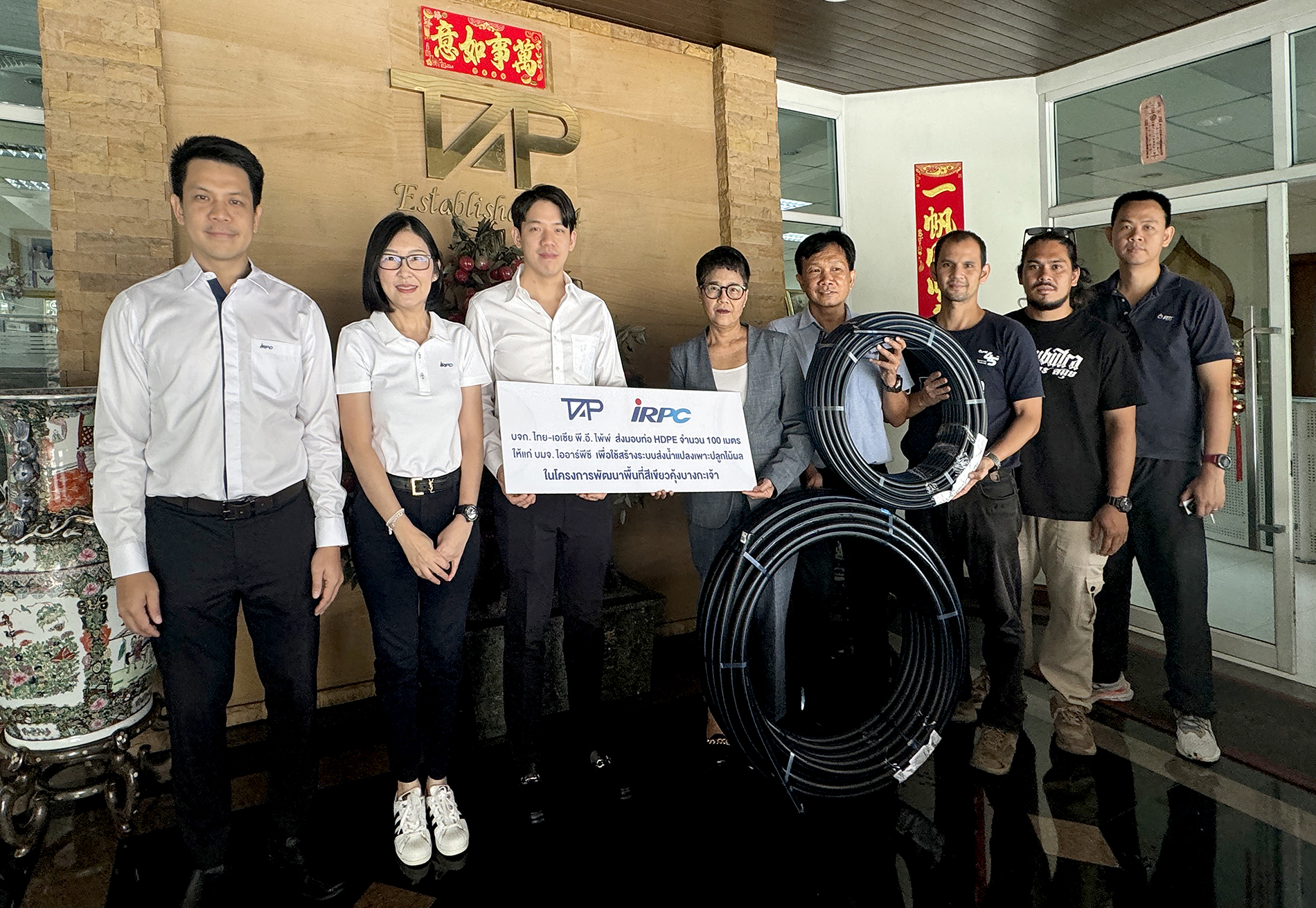

IRPC continues to uphold its CSR commitments. Following the recent Myanmar earthquake, the company partnered with Leela Poly Co., Ltd. and Sahachit Watana Plastic Industry Co., Ltd. to provide waterproof plastic sheeting and infectious waste bags through the Royal Thai Armed Forces and the BMA. IRPC engineers and volunteers also collaborated with PTT Group and the State Railway of Thailand to assess damage at the Railway Housing Estate, Kilometre 11.

Live Stream

Live Stream